The largest UAE-based institution is First Abu Dhabi Bank (FAB). Thousands of customers and businesses trust it to offer safe and effective banking services. Banking is one of the most crucial jobs, and as such, the balances of your account are monitored to allow customers to keep track of their money to control how they spend it, in addition to avoiding the threat of overdrafts. This tutorial takes you step by step through each of the ways to check your Fab Balance the easy way.

Background on the Significance of FAB Check Balance.

Note that the balance of your bank account is not only interested in how much money you have. It is an essential issue for your economic health.

Why Do You Check Your FAB Account Balance on a regular basis?

1. Track Financial Activity

Periodically balancing your account can be beneficial in monitoring activities such as deposits on your salary, your payments made on bills, card credit withdrawals, and ATM withdrawals.

2. Detect Fraudulent Transactions

Unauthorized access or some suspicious transactions would be identified at the initial stages in case you frequently check your account balance.

3. Avoid Overdrafts or Declined Payments

Knowing your balance is an assurance that you do not spend more than you have; hence, no charge will be given in case of an overdraft.

4. Manage Budgeting and Savings

Having the full picture of money available can allow you to make budgets both on the monthly level and on the level of savings. It also reminds you to control your spending habits.

Must Visit: NBAD Balance Check in UAE: 5 Reliable Methods for 2025

Methods to Check FAB Account Balance

FAB offers diverse online and offline possibilities to see your balance in an easy manner.

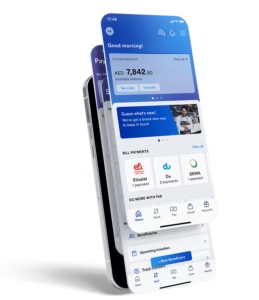

1. FAB Mobile Banking App

- Track Financial Activity

- Periodic review of your account balance may assist in keeping a check on transactions such as salary deposits, paying bills, debiting your credit card, and withdrawals made at an ATM.

- Identify Unauthorized Payments.

- The fraudulent activities or suspicious transactions might be identified at the initial stage in case you are habituated to checking the balance of your account.

- Prevent Overdrafts or Payment Refusal.

- Being aware of your balance is a guarantee that you do not spend more than you have; therefore, you do not pay to be overdrawn.

- Administer Financing and Saving.

- The full picture of the funds you have would assist in developing both the monthly budgets and in savings allocations. It also makes you control your spending habits.

- How to Open a FAB Bank Account Online in Simple Steps: Must Visit.

- Ways to tell the FAB Account Balance.

- FAB offers numerous online and offline means to check your balance conveniently.

- FAB Mobile Banking App

- The mobile application of FAB is one of the most efficient ways to manage your account, which also contains balance inquiries.

FAB Mobile App: How to check your balance:

- Patronize the FAB Mobile App on the Google Play official FAB Mobile App or the Apple App Store.

- Enter your mobile number on which you registered the account, and your password. It is also possible to use biometric authentication (Face, Fingerprint, or ID).

- The dashboard shows you the balance of your account in real time.

- Select your name in the account to view your transactions, deposits, and deductions made, and transactions pending.

Features:

- Check balances in real-time.

- Secure login and security.

- Possibilities to block cards or change PINs in the application.

- Complete transaction history.

2. FAB Online Banking (Internet Banking)

This is the method applicable to people who would like to check their bank accounts using a computer or laptop.

Steps to Check FAB Balance via Online Banking:

- The official FAB site is: https://www.bankfab.com.

- Click on the home page, either the button of the “Login” button or the actual word login.

- Enter your user name and password.

- Once you log in, visit it to go to the section of Accounts.

- Select an account and see the balance and other details.

Feature

- Get and read e-statements.

- Move around funds.

- Control credit card use.

- Set account alerts.

3. ATM Balance Inquiry

To individuals who lack technological skills or those who are just used to looking at the FAB balance through the internet, machines are a convenient method of checking the bank balance.

Steps to Check Balance Using FAB ATM:

- Visit any of the local FAB ATM or FAB ATM partners compatible with FAB cards.

- Insert your debit card.

- Enter your 4-digit PIN.

- Click on the menu Balance Inquiry.

- Your account balance will be shown at the top of the screen. One can also print a receipt.

Features:

- Does not need an internet connection.

- Available 24/7.

- It also allows cash withdrawals, a mini statement, and PIN change.

4. FAB Balance Check by SMS

FAB provides its customers with a feature of SMS banking where they are reminded about their balance in a short text message.

Activation & Usage:

- Make sure that your mobile phone number is registered in FAB database.

- You can start your SMS application and type in the following text:

BAL space: The final 6 numbers of your account number

This SMS can be sent to 2121.

- The balance will be emailed to you in a few hours.

Advantages:

- No Internet access is required.

- Balance check on the road.

- Perfect with older models of phones.

5. FAB Customer Service

If you’re looking for a human touch, FAB’s support team is on call 24/7 to assist in balance queries.

Contact Numbers:

- Inside UAE: 600 52 5500

- International: +971 2 681 1511

After you have verified that you are who you say it is (account #, Emirates ID, or security concerns), the representative will inform you of your balance.

Tip: Keep your account details ready for quicker service.

6. FAB Ratibi Card / Prepaid Card Balance Check

Employers who get their pay via the FAB Ratibi or through prepaid cards are able to examine their balances through an online portal.

Steps to Check Ratibi Card Balance:

- Go to: https://ppc.bankfab.co.m

- Enter:

- The two digits that make up the last 2 of the number on your card.

- Your card’s ID (printed on the back of your card).

- Select “Go” to view your balance.

Features:

- Secure and instant access.

- Particularly designed for FAB people who have a salary card.

Troubleshooting Common Issues During FAB Balance Check

Problem: Can’t Log in to Mobile or Online Banking

Solution:

- Forgot your password? Reset it using your “Forgot Password” option.

- Verify that your mobile number is correct in its registration.

- Clear caches or update the application.

Problem: SMS Balance Check Not Working

Solution:

- Verify that your mobile phone number is associated with your FAB account.

- Verify that you’re using a proper format (BAL ).

- Contact customer support to confirm the status of SMS banking.

Problem: Card Not Working at ATM

Solution:

- Verify if the card is damaged or expired.

- Go to the nearest FAB branch for the replacement of your card.

Security Tips for FAB Balance Inquiry

- Always log out after using mobile or online banking.

- Be sure not to divulge your banking details to anyone.

- Beware of public Wi-Fi when checking your bank accounts.

- You can enable two-factor authentication for additional security.

Summary

FAB gives you a range of safe, quick, convenient, and secure choices for checking the balance on your account. If you’re looking for digital options such as FAB Mobile App and internet banking, FAB Mobile App or internet banking, or the traditional options including ATMs and SMS, keeping track of the balance on your account is simple and secure. This guide walks you through each method to verify your FAB balance check.

Most Recommended Options:

- FAB Mobile App for real-time updates.

- Online Banking is a convenient way to manage your account. Administration.

- Prepaid Portal for Ratibi Cardholders.

Whichever method you decide to use, maintaining a record of your FAB balance will help you control your financial situation more effectively.

Related Blog: NBAD Balance Check in UAE: 5 Reliable Methods for 2025

Table Summary:

FAB Balance Check table:

| Method | Steps | Notes |

| Mobile App | Open FAB App → Login → See Balance | Fast & secure |

| Online Banking | Go to FAB site → Login → Accounts | Needs internet |

| ATM | Insert Card → Balance Inquiry | Works 24/7 |

| SMS | Send SMS to FAB number | Must be registered |

| Phone | Call FAB helpline → Follow menu | 24/7 support |

FAQ’s

- How to check my FAB account balance?

Use the FAB mobile app or SMS service (BAL [space] last 6 digits of your account to 2121), or visit an ATM to check your balance. - Can I check my balance offline?

Yes, text BAL followed by the last 6 digits of your account to 2121 or visit an ATM. The mobile app requires internet access. - What if the FAB mobile app isn’t working?

Try resetting your password, updating the app, or clearing your cache. Ensure your account number is valid. - Is there a helpline for balance inquiries?

Call 600 52 5500 within the UAE, or +971 2 681 1511 for international queries. - How can I protect my balance while checking it online?

Always sign out after use, avoid public Wi-Fi, and enable two-factor authentication for added security.

This keeps the key information in a more compact form.